Enjoy university with freedom of financial flexibility.

Our student bank account makes managing your money simple.

Hassle-free banking

Borrowing with an

Apply for an account online

Apply for a Student account online in as little as 10 minutes

If accepted, you can then apply for an overdraft - you’ll need to be 18 or over and a UK resident to apply

You'll need your passport or full UK/EU driving licence - not provisional - to confirm your identity

You’ll need a mobile phone or tablet that can scan a QR code and take a picture for our ID check

Or apply in branch

If you’d rather open a Student account face to face, then visit us in branch

You can book an appointment for a time that works for you

To get a student account, you’ll need to show some identification, a proof of address, and a letter from your university or college that confirms your place. To get started, please book at appointment at your local branch and bring these documents with you.

We can take your UCAS email as proof that you’re a student, but it can’t be used as your proof of address.

If you haven't lived in the UK for at least 3 years, for example if you’re an International Student, you won’t be able to apply for this account.

You can see a full list of what we’ll accept as proof of ID or address here.

To qualify for TSB’s student bank account, you:

You don’t need to wait until you start your course to apply for a student bank account. You can apply for one as soon as you receive your UCAS confirmation letter. You can also apply for a student bank account once your course has begun.

At TSB, we stagger our student overdrafts to help you get used to borrowing. Because of this, the amount you get changes:

You’ll have to apply and be approved for all overdrafts amounts, and all overdrafts are repayable on demand.

Yes and no. Applying for a student overdraft on its own doesn’t affect your credit score. However, when you use your overdraft it will show as borrowing on credit reports. That means that if you go over your overdraft limit or have payments rejected, it can negatively affect your credit score. If this happens, it can make it more difficult to borrow in the future.

We’ve created a guide to credit ratings if you want more information about credit scores and how they work.

Going over your arranged overdraft limit can negatively affect your credit score, which may make it harder to borrow in the future.

This can happen if you don’t have enough money in your account – including any arranged overdraft limit – to pay for something. If you try and make a transaction, you’ll automatically be asking for an unarranged overdraft.

It’s important to know that unarranged overdrafts are not guaranteed. This means you might not be approved and the payment may be rejected.

If you are approved for the unarranged overdraft, you’ll be charged interest on the amount you borrow. You can use our overdraft calculator to see how much it might cost.

Once you graduate, you can turn your student bank account into a graduate bank account. You can have a graduate bank account for up to three years following your graduation. The optional arranged overdraft up to £2,000 remains interest free for 3 years after graduation.

While you’re studying, your arranged overdraft is interest free up to £1,500.

Once you switch to a graduate account, any arranged overdraft will be interest free up to £2,000 for 3 years.

You should be aware that overdrafts are intended for short-term borrowing. Because of this, we’ll regularly review how you’re using it. If overdrafts are no longer suitable for your needs, we’ll get in touch to let you know that we’ll reduce or remove it.

If you’re struggling to repay your overdraft, or you find that you’re always using your full limit, we’re here to help. It won’t affect your credit score to talk to us and get support.

If you are studying full-time for a master's degree or PHD, you can qualify for, or extend, your student bank account.

It's important that you understand how your account works.

You can find all the documents relevant to this account in the Important Documents section. Rates and charges can be found within the Banking Charges Guide.

Internet Banking

The quick and easy way to control your money. Pay bills, check balances, transfer money between accounts, set up and cancel standing orders, view and cancel Direct Debits and more.

Get started with Internet Banking

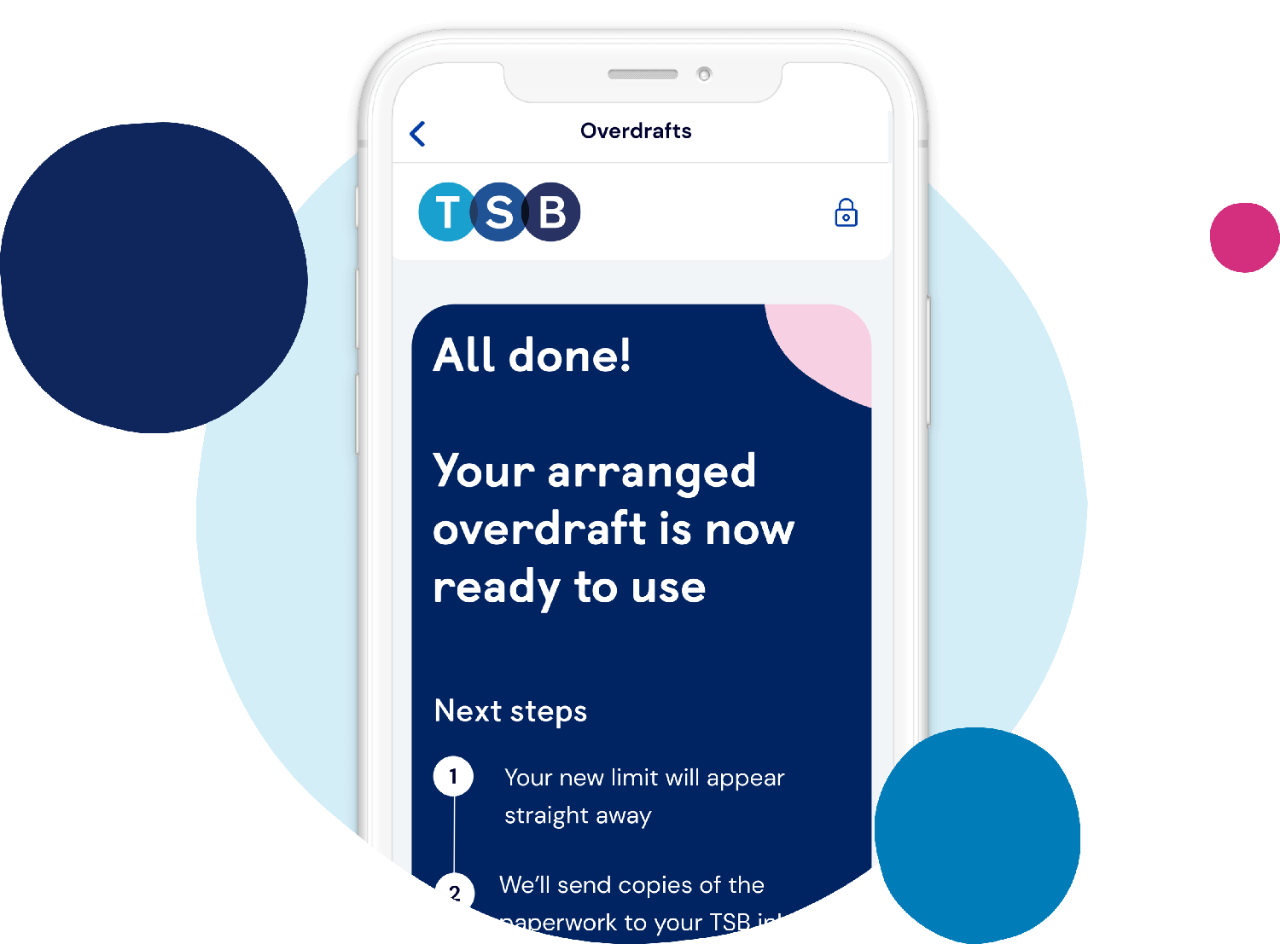

Mobile Banking

Make it easier to manage your money on the go. It means you can do your banking on the move from most Internet-enabled mobile devices - either using our app or via your mobile device's browser.

Get started with Mobile Banking

Telephone Banking

You can call our automated Telephone Banking service on 03459 758 758.

Use this quick service to:

And you can speak to one of our advisers if you have a more complex query between 8am – 8pm Monday to Sunday.

These services are available if you are over 16.

Your TSB Visa debit card is an amazing piece of plastic. Accepted in millions of places and cash machines worldwide, it's incredibly convenient. It's just as safe to use abroad as at home, so it's a simple alternative to carrying cash.

In your first year of studies you can apply for an interest free Arranged Overdraft up to £1,500 (subject to application and approval). Starting with £500 for the first six months. You can then apply to increase it to £1,000 in months seven to nine and from month ten up to £1,500 – helping you to manage your spending over your first year.

Full details about arranged and unarranged overdrafts and charges

Our Grace Period gives you until 10pm (UK time) to pay enough money into your account to avoid any overdraft interest that we may charge that day.

Our Retry Periods mean that if you don’t have enough money in your account to allow us to pay Direct Debits, cheques, standing orders and future dated payments, we’ll give you time to put money into your account to make these payments.

Retry periods

We’ll try to take the payment shortly after midnight on the due date or next working day, or again after 2.30pm that same day. For standing orders and future dated payments, we’ll also retry a third time to take payment, this will be shortly after midnight the following working day.

The money needs to be immediately available to use. You can transfer money from another account with us using mobile banking, Internet Banking, Telephone Banking or by paying in cash over the counter in a branch.

For the payment to be made you need to deposit enough money to meet the payment amount.

If you don’t have enough money in your account to pay a standing order 3 times in a row, we’ll cancel it. For example, if you have a monthly standing order and don’t have enough money to pay it 3 months in a row.

To help you balance your finances you can apply for a TSB Student Credit Card with a minimum limit of £500 Representative 21.9% APR variable (subject to status and being 18 years or over). You'll get up to 56 days interest free on purchases if you pay off the balance in full every month by the payment date shown on your statement.

You’ll need to have had a TSB Student account for at least three months and have a regular income before you can apply for a TSB Student Credit Card

View summary box containing rates and charges and an illustrative example (PDF, 94KB)

There may be lots of different reasons you might need to bank with us differently, either in the short term, or on a continuing basis. It could be because of your physical or mental wellbeing, or because of a life event you’ve experienced. Whatever the reason, we are committed to tailoring our support to your personal needs.

If you choose to tell us about your individual support needs, we will take the time to understand your circumstances and work with you to make sure you have the support you need when banking with TSB. We can add a Support Indicator to your account, which means whenever you talk to us, we'll be aware that you may need tailored support.

Important information

Account Opening is subject to our assessment of your circumstances. You must be 17 or over and a UK resident to apply. Interest paid monthly.

Overdrafts are subject to application and approval and are repayable on demand.

*AER stands for Annual Equivalent Rate and tells you what the interest rate would be if it was paid as only one payment, once each year. Gross rate is the agreed rate of interest payable to you before the income tax is deducted at the rate specified by the law.

The representative APR is the Annual Percentage Rate of charge. You can use it to compare the overall cost of credit between different lenders.

Text alerts are free but your mobile operator may charge for some services. Please check with them.

We don’t charge for your use of Mobile Banking but your mobile operator may charge for some services, please check with them. Mobile Banking is available on most internet enabled mobile devices. Services may be affected by phone signal and functionality. You must be registered for Internet Banking. Terms and conditions apply.

Apple, the Apple logo, Apple Pay, Apple Watch and iPhone are trademarks of Apple Inc. registered in the US and other countries.

Google Pay is a trademark of Google LLC. Android, Google Pay, and the Google Logo are trademarks of Google LLC.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Co. Ltd.