How to budget for Christmas

Prepare for a joyful holiday season without breaking the bank. TSB Bank’s guide reveals smart strategies for budgeting and celebrating Christmas stress-free.

Stay safe online: We will never contact you asking for your login details or link you to a web page that asks for personal information. Visit our fraud prevention centre

You might be interested in...

Bring your debts together

With loans starting at 5.6% Representative APR, you could reduce your monthly payments. Try our loan calculator to see if you could save.

T&Cs apply*.

Are you eligible for a credit card?

Use our eligibility checker to find out if you'll be accepted. Subject to approval. 18+ UK resident.

T&Cs apply**.

Money worries If you’re struggling with the cost of living, you’re not alone. We’re here to help you get the support you need. Visit our money worries page.

Bank of England: On 18 December 2025, the Bank of England announced a decrease to its base rate from 4.00% to 3.75%. Find out more.

Our experts answer your big questions to help you become more confident with your money every day.

Need extra support?

There may be all sorts of reasons you might need us to work with you differently. We're here to help.

Got a question?

Trouble logging in or need help with your banking? Head to Help and Support for answers.

Want to chat?

Give us a call, or chat to us online and in the app using TSB Smart Agent.

Published August 2025

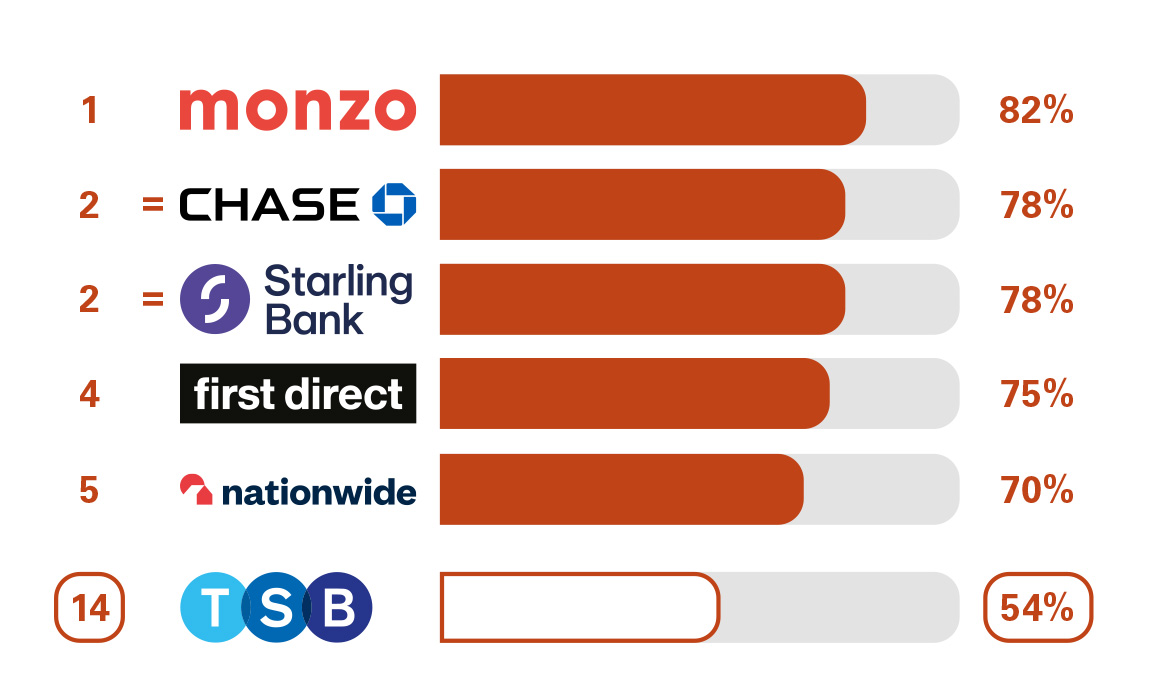

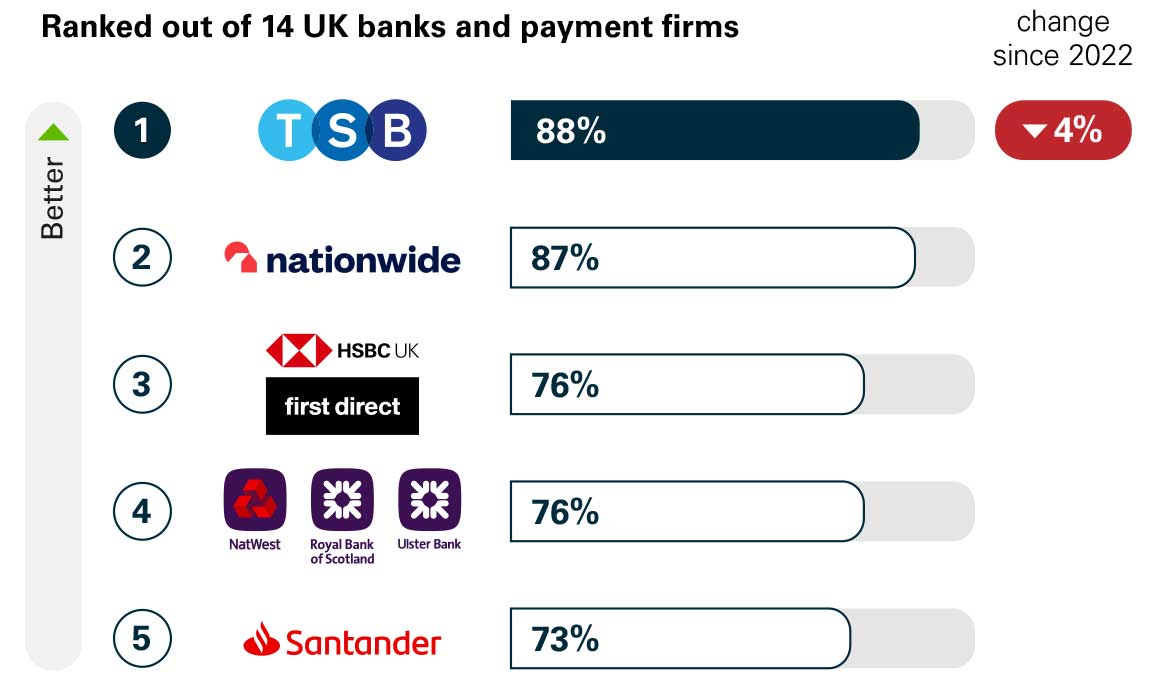

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,000 customers of each of the 17 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

We asked customers how likely they would be to recommend their personal current account provider to friends and family.

Ranking

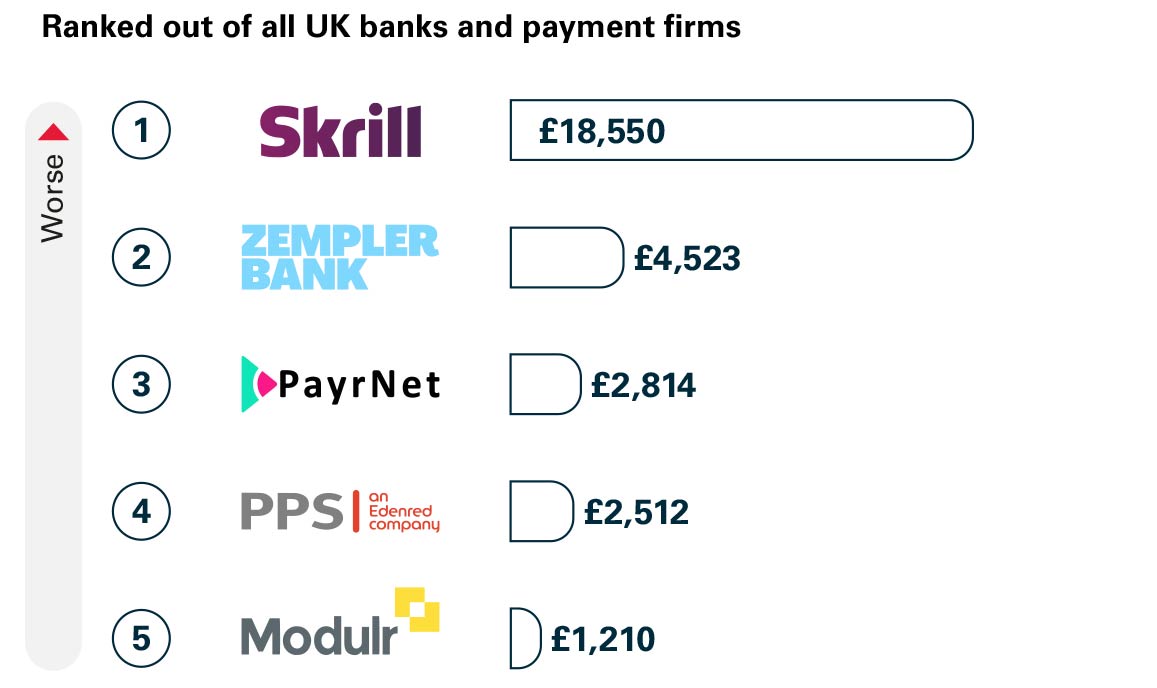

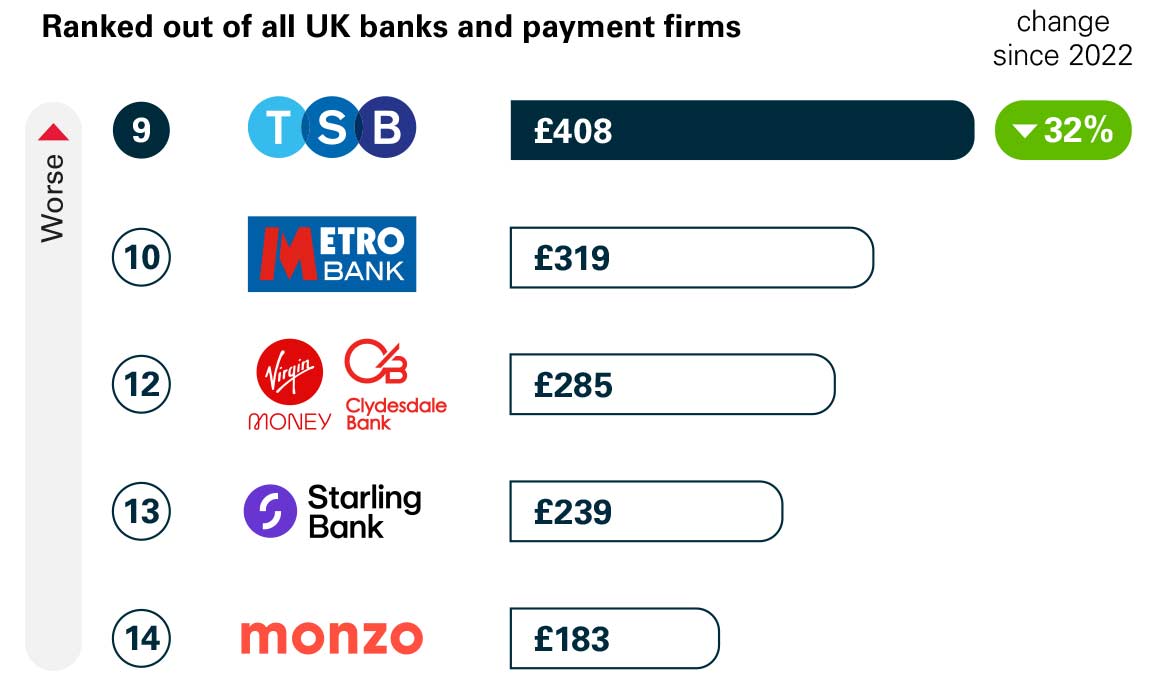

Authorised push payment (APP) scams happen when someone is tricked into transferring money to a fraudster’s bank account.

These charts use data given to the Payment Systems Regulator by major banking groups in the UK in 2023.

You can read the full report by visiting www.psr.org.uk/app-fraud-data

This is the proportion of total APP fraud losses that were reimbursed, ranked out of 14 firms.

This is the amount of money received into the scammer’s account from the victim, ranked out of all UK banks and payment firms.

For example, for every £1 million received into consumer accounts at Skrill, £18,550 of it was APP scams.

This is the amount of money sent from the victim’s account to the scammer, ranked out of 14 firms.

For example, for every £1 million of TSB transactions sent in 2023, £266 was lost to APP scams.

This is the amount of money received into the scammer’s account from the victim, ranked out of all UK banks and payment firms.

For example, for every £1 million received into consumer accounts at TSB, £408 of it was APP scams.

We're covered by the Financial Services Compensation Scheme (FSCS). This means that any money you hold in a TSB account is protected up to a limit of £120,000 - so you won't lose out.

Never transfer money to, or share passwords with, someone you don’t trust. This includes people online you’ve never met, too-good-to-be-true investments, and companies asking you to transfer funds directly to them.

Important information

*Eligibility applies. Subject to application and approval.

The representative APR is the Annual Percentage Rate of charge. You can use it to compare the overall cost of credit between different lenders.

**The issue of a credit card is subject to status and depends on our assessment of your circumstances.